TISA Tells Its Real Name: Unpacking The Truth Behind The Acronym And The Institution

Have you ever come across the term "TISA" and wondered what it truly means? It's almost like a name you hear often, yet its full identity might still feel a bit hidden. So, it's pretty common for people to wonder, "tisa tells real name," trying to figure out just what this familiar-sounding acronym stands for in various situations.

Very often, when we talk about TISA, our thoughts might go straight to banking rules or perhaps even a place where people keep their money safe. It seems to pop up in conversations about how financial institutions work, or perhaps about saving up for something important. You know, like when you are looking at different ways to manage your money, TISA could be a part of that discussion.

Actually, TISA has more than one significant meaning, and understanding both is quite helpful for anyone dealing with money matters. We are going to explore the two primary identities of TISA, shedding light on its role as a vital banking regulation and its place as a considerable financial institution. This way, you will get the full picture of what TISA really is.

Table of Contents

- What is TISA Anyway? The Truth in Savings Act

- TISA: The Regulation Explained for Consumers

- Why TISA Matters for Your Money Decisions

- Understanding Account Disclosure Requirements

- TISA and Overdraft Services

- TISA: The Financial Institution

- Teachers Savings and Loan Society Limited: A Closer Look

- Savings Opportunities in Papua New Guinea

- Connecting the Dots: TISA's Dual Identity

- Frequently Asked Questions

- Final Thoughts on TISA's Identity

What is TISA Anyway? The Truth in Savings Act

When people ask, "tisa tells real name," a lot of the time, they are thinking about a really important set of rules in the banking world. This TISA is actually the Truth in Savings Act, which is also known as Regulation DD. It's a fundamental piece of legislation that helps everyday folks make smart choices about their bank accounts, and it's been around for a while, becoming effective in June 1993, so it's a well-established part of how banks operate.

The main idea behind this act is pretty straightforward: it wants to make sure you get clear, understandable information from banks. This way, you can compare different accounts and pick the one that fits your needs best. So, in some respects, it's all about transparency, ensuring you know what you are getting into before you open an account. It truly helps consumers feel more confident when they are dealing with their money.

For instance, if you work in a branch of a foreign bank operating in the United States, you'd know that even if that branch only opens deposit accounts for existing customers of the foreign bank, these TISA rules still apply. They are universal guidelines for how financial institutions present deposit accounts to consumers. This shows how broad its reach is, covering many different banking setups.

TISA: The Regulation Explained for Consumers

Let's talk a bit more about what TISA, the Truth in Savings Act, means for you, the person who uses bank accounts. This regulation, Regulation DD, sets out how banks must show you details about their checking accounts, savings accounts, and even certificates of deposit, or CDs. It's basically about making sure banks give you a fair and complete picture of what to expect, which is pretty important for your personal finances.

Why TISA Matters for Your Money Decisions

This act was put in place to help consumers make informed decisions about bank accounts, which is a very good thing. It requires banks to provide certain disclosures to consumers. These disclosures are like a guidebook for your account, telling you about interest rates, fees, and other terms. So, you can look at different options and really understand what each one offers before you commit, which is rather useful when you are trying to save or manage your funds.

For example, knowing the interest rate you can earn on a savings account, or the fees associated with a checking account, helps you pick the right product. The goal is to avoid surprises and ensure you know the full cost or benefit of your banking choices. This kind of information empowers you, making you a more knowledgeable bank customer, and that, you know, makes a big difference.

Understanding Account Disclosure Requirements

The Truth in Savings Act outlines specific disclosure requirements for deposit accounts. This means banks can't just tell you anything; they have to provide certain pieces of information in a clear way. This includes details about how interest is calculated, any minimum balance requirements, and what charges you might incur. It's all about making sure the fine print is actually readable and understandable for everyone, so you are not left guessing.

These requirements are a big part of what makes banking more transparent. A course introducing Regulation DD and TISA would typically provide an overview of these disclosure requirements for various deposit accounts. It's about providing the fundamental knowledge necessary for professionals working in bank compliance, so they can make sure these rules are followed. This ensures that the information you receive is consistent and complete, which is really helpful.

You can often find implementation and guidance materials available on websites of regulatory bodies, helping both banks and consumers understand these rules better. This kind of resource helps everyone stay on the same page about what needs to be disclosed and how. It's a way of making sure that the spirit of the act, which is consumer protection, is truly upheld.

TISA and Overdraft Services

Interestingly, the Truth in Savings Act also touches upon areas like overdraft services. While these services might seem like something separate, they are actually regulated under Regulation DD, which implements TISA. So, even when it comes to those discretionary overdraft services, they are not unregulated; there are rules about how banks must present them and what information they need to share with you, which is pretty reassuring.

The banking industry, through groups like the American Bankers Association, has expressed concerns about certain aspects of how these regulations are issued, for example, by the Federal Deposit Insurance Corporation (FDIC). This shows that the rules around TISA and Regulation DD are actively discussed and refined, reflecting the ongoing effort to balance consumer protection with banking operations. It's a dynamic area, to be sure.

Knowing that even overdrafts have rules under TISA means you have a better chance of understanding the costs involved before you use such a service. This is part of the broader aim of TISA: to help you make informed decisions about every aspect of your bank account, even the unexpected ones. It's about bringing clarity to situations that could otherwise be quite confusing, which is something many people appreciate.

TISA: The Financial Institution

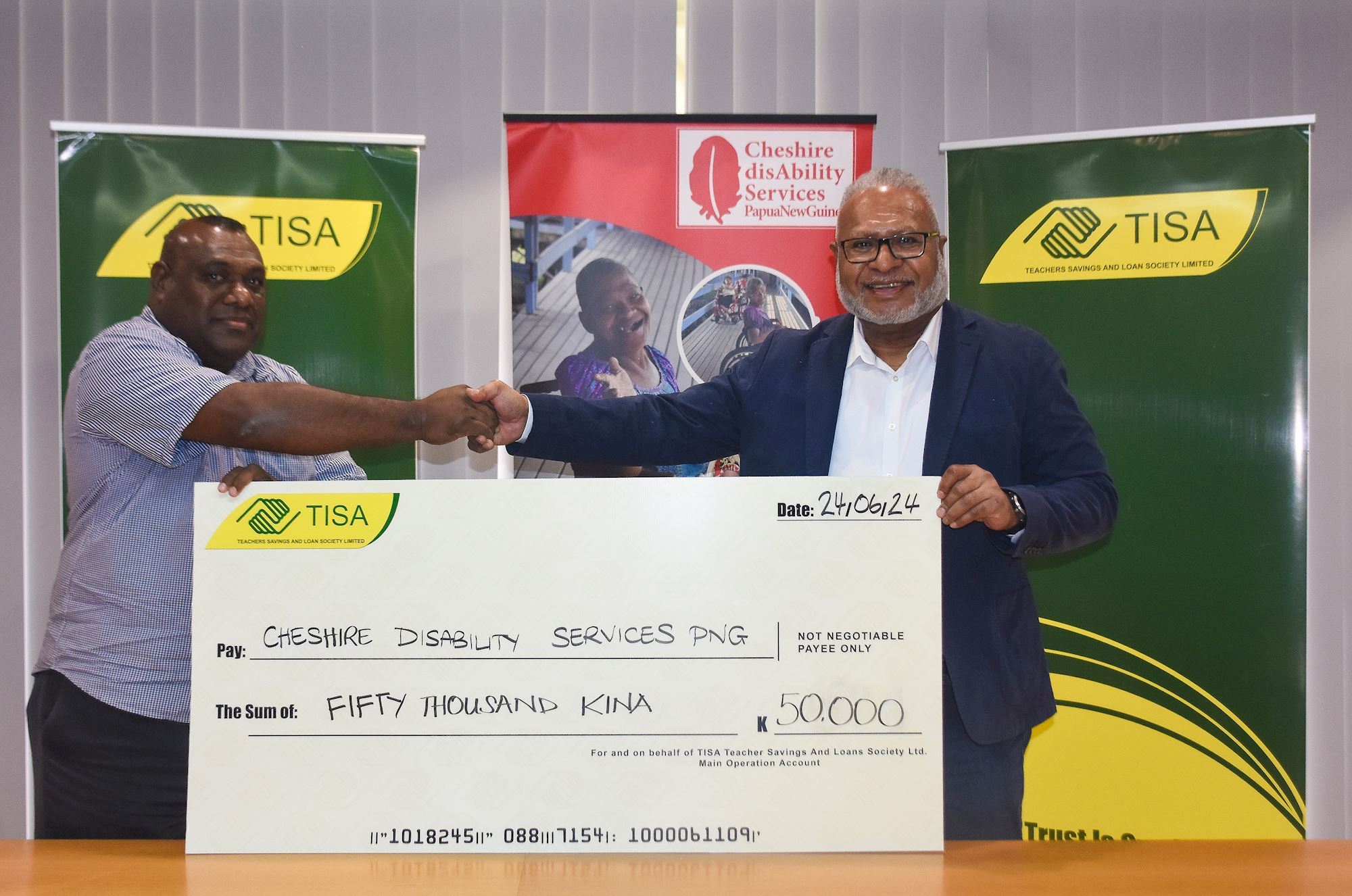

Now, let's look at the other significant meaning of TISA when someone asks, "tisa tells real name." This TISA is not a regulation but a very real financial institution, specifically the Teachers Savings and Loan Society Limited. This organization has a quite distinct identity and plays a big role in its region. It's a completely different kind of TISA from the banking regulation we just talked about, which is why the confusion sometimes happens.

Teachers Savings and Loan Society Limited: A Closer Look

The Teachers Savings and Loan Society Limited, known as TISA, is a major player in its financial landscape. It offers a range of savings accounts, giving people opportunities to earn interest on their money. For example, some of their savings accounts allow people to earn up to 6% interest per year, which is a pretty good return for savers. This TISA is focused on helping individuals grow their savings, which is a core part of its mission.

This institution provides foundational knowledge and training necessary for professionals working in bank compliance, in a way. It's about making sure their services are sound and reliable for their customers. They also communicate regularly, like with weekly email dispatches about product updates and news, so their customers stay informed. This level of communication is quite helpful for members.

Savings Opportunities in Papua New Guinea

The Teachers Savings and Loan Society Limited, or TISA, holds a very prominent position in Papua New Guinea. It is, in fact, the largest savings and loans society in that country. This means it serves a lot of people and is a key part of the financial well-being for many individuals there. Its size and reach suggest it's a trusted place for people to save their money, which is very important for a country's economic health.

This TISA offers various savings products, and sometimes there are specific terms around them, like rules about converting or redeeming funds within a certain period. For example, some TISA funds might have conditions where if you move or redeem them before 24 months of continuous contributions, you might face a temporary suspension from starting new regular contributions for six months. These details are important for customers to understand their savings options fully, so you really need to read the fine print.

The focus here is clearly on savings and loans, providing financial services to a large segment of the population. It's a testament to how different organizations can share an acronym but have entirely distinct purposes and locations. This TISA is deeply embedded in the community it serves, providing valuable financial tools for its members, which is pretty significant.

Connecting the Dots: TISA's Dual Identity

So, when you hear someone say, "tisa tells real name," you can see why there might be a moment of confusion. The term "TISA" has at least two very important and distinct meanings. One is a critical piece of banking regulation, the Truth in Savings Act, which makes sure you get clear information about your bank accounts. The other is a large and important financial institution, the Teachers Savings and Loan Society Limited, based in Papua New Guinea. It's quite interesting how one acronym can represent such different entities.

Understanding the context is key. If you are talking about bank disclosures, overdraft services, or how interest rates are presented on deposit accounts in the United States, you are almost certainly referring to the Truth in Savings Act. That's the TISA that helps protect consumers and ensures transparency in banking. It's a foundational part of financial compliance, you know, for banks and credit unions alike, as the National Credit Union Administration also implements this act.

However, if the conversation shifts to savings accounts in Papua New Guinea, or a large savings and loan society, then you are probably talking about the Teachers Savings and Loan Society Limited. This TISA is all about providing financial services and helping people save money in a specific geographical area. It just goes to show that a single set of letters can have a completely different identity depending on where and how it's used, which is a bit of a linguistic puzzle.

Frequently Asked Questions

What is the main goal of the Truth in Savings Act (TISA)?

The primary goal of the Truth in Savings Act, also known as Regulation DD, is to help consumers make truly informed decisions about their bank accounts. It does this by requiring banks to give clear, easy-to-understand disclosures about account terms, interest rates, and fees. This way, people can compare different options and choose what works best for them, so it's all about empowering the consumer.

Does TISA regulate overdraft fees?

Yes, the Truth in Savings Act (TISA), through its implementation in Regulation DD, does regulate discretionary overdraft services. While these services might seem separate, the rules under TISA ensure that banks provide consumers with disclosures about how these services work and any associated costs. This means there are guidelines even for these kinds of fees, which is pretty helpful for account holders.

Where is the Teachers Savings and Loan Society Limited (TISA) located?

The Teachers Savings and Loan Society Limited, often referred to as TISA, is located in Papua New Guinea. It is actually the largest savings and loans society in that country, providing a range of savings accounts and other financial services to its members there. So, its operations are focused within that specific region, serving its local community.

Final Thoughts on TISA's Identity

It's fascinating how a simple four-letter acronym like TISA can represent such different, yet equally important, concepts. Whether it's the Truth in Savings Act, which safeguards your banking choices, or the Teachers Savings and Loan Society Limited, which helps people save in Papua New Guinea, both play a really significant role in the financial world. Understanding which "TISA" someone is talking about just makes conversations about money a little clearer.

Knowing the "real name" behind these different uses of TISA helps you be a more informed consumer and a more knowledgeable participant in financial discussions. It's a good reminder that context is everything when you are trying to understand terms that appear in various places. You can learn more about financial regulations on our site, and perhaps even link to this page for tips on maximizing your savings.

So, the next time you hear "TISA," you'll know to consider the situation. Is it about consumer protection in banking, or is it about a prominent financial institution helping people save? Either way, you're now better equipped to understand its true identity, which is pretty neat.

TISA News

TISA News

TISA News