Finding The Top Tax Preparer In Tulsa: Your Guide To A Smooth Tax Season

Thinking about tax time can sometimes feel a bit heavy, can't it? For many folks in Tulsa, getting ready for the tax deadline brings up questions about finding someone good to help. You might be wondering how to pick out a real standout from the crowd, someone who truly knows their stuff. It’s a pretty common feeling, you know, wanting to make sure your financial papers are in the right hands.

When we talk about someone being "top," it often means they are at the very highest point, or perhaps they show the best quality in what they do. Just like the highest part of a building or the best quality of a product, a top tax preparer in Tulsa holds a position of preeminence in their field. They are the ones who seem to know just how to handle your specific situation, which is really something special.

This article is here to walk you through what to look for, so you can feel good about your choice. We will talk about what makes a tax helper truly stand out, and how you can go about finding that person right here in Tulsa. It's about getting peace of mind, basically, which is a big deal for anyone dealing with their money, you know.

Table of Contents

- Why a Top Tax Preparer Makes a Difference

- What Makes a Tax Preparer "Top"?

- Finding Your Top Tax Preparer in Tulsa

- Common Questions About Tax Preparers

- Making the Most of Your Tax Preparation

- Your Next Steps to a Great Tax Season

Why a Top Tax Preparer Makes a Difference

Having a top tax preparer in Tulsa can really change how you feel about tax season. It's not just about getting the forms filled out, you know. It's about having someone who can look at your whole financial picture and help you make smart choices, perhaps even saving you some money. This is especially true for those with different kinds of income or special situations.

For instance, if you own a small business here in Tulsa, your taxes can get pretty involved. There are so many rules and things to keep track of, and honestly, it can feel like a maze. A skilled tax preparer can help you sort through all of that, making sure you get all the credits or deductions you are supposed to. They can help you avoid problems, too, which is a huge relief.

They also stay up-to-date on all the latest changes in tax laws. These laws can shift quite a bit from year to year, and keeping up with them yourself is a big job. A good preparer takes that burden off your shoulders, which is pretty nice. They know what's new for this year, and how it might affect your money situation, naturally.

It's not just about saving money, though that is certainly a good part of it. It is also about peace of mind. Knowing that your taxes are done correctly, and that you have someone reliable looking out for you, can make a world of difference. That feeling of security is, well, priceless, in a way.

So, choosing someone truly good means you are getting more than just a service. You are getting a partner who helps you handle an important part of your financial life. They are there to answer your questions and guide you, which is a big comfort, really.

What Makes a Tax Preparer "Top"?

When you are looking for a top tax preparer in Tulsa, you are searching for someone who goes above and beyond. It is not just about having a license, though that is certainly important. It is about a combination of things that make them stand out, you know. Think about someone who truly understands what they are doing and cares about helping you.

Experience and Knowledge

A top tax preparer has a deep understanding of tax rules. They know the ins and outs of federal, state, and even local tax codes. This knowledge comes from years of doing taxes for all sorts of people and businesses. They have probably seen a lot of different situations, which means they can handle yours, too, basically.

They also keep learning. Tax laws are always changing, so a good preparer is always studying and getting new information. They might attend special classes or seminars to stay current. This means they are always ready for whatever new rules come along, which is pretty cool, if you ask me.

For example, if you have investments or you just bought a home, a very good preparer will know how those things affect your taxes. They will be able to point out things you might have missed, or ways to organize your financial life for next year. They often have a knack for seeing the whole picture, you know.

They are also good at figuring out tricky situations. Maybe you had a big life change, like getting married or starting a family. A top preparer knows how these events play into your tax forms. They can give you advice that fits your life right now, which is super helpful, actually.

Their knowledge means they can often spot potential issues before they become problems. This could mean avoiding a notice from the tax office or just making sure everything is filed correctly the first time. It is about being thorough, and that comes from a lot of learning and doing, in fact.

Clear Communication

A top tax preparer talks to you in a way that makes sense. They do not use a lot of confusing jargon or technical words that leave you scratching your head. They explain things clearly, so you understand what is happening with your money. This is very important, because taxes can be pretty confusing for most people.

They are also good listeners. They take the time to hear about your specific situation and any questions you have. You should feel comfortable asking them anything, no matter how small it seems. A good preparer makes sure you feel heard and understood, which is really nice, you know.

For instance, if you ask about a certain deduction, they should be able to tell you simply whether you qualify and why. They might give you a simple example to help you get it. This kind of clear talk helps you feel more in control and less stressed about the whole process, too it's almost.

They also keep you informed throughout the process. You should know what steps they are taking and when your taxes are expected to be ready. There should not be any surprises. This open way of working builds trust, which is a big part of finding a top tax preparer in Tulsa, obviously.

If you feel like you are just being told what to do without understanding why, that might be a sign to look elsewhere. A truly good preparer wants you to feel confident about your tax situation, and clear communication is a big part of that, as a matter of fact.

A Personal Touch

The best tax preparers treat you like a person, not just another set of numbers. They understand that your financial life is unique, and they take that into account. They might remember details about your family or your job from year to year, which shows they care, in a way.

They are approachable and friendly. You should feel comfortable talking to them about your money, even the parts that might feel a little awkward. A good relationship with your preparer can make the whole tax experience much less stressful. It is about building a connection, you know.

For example, they might ask about your plans for the coming year, like if you are thinking of buying a house or starting a side gig. This helps them give you advice that is useful not just for today, but for your future, too. They are thinking ahead with you, which is really something special.

They are also reliable. If they say they will do something, they do it. If you call with a question, they get back to you in a reasonable amount of time. This kind of dependability is a mark of a true professional. You can count on them, basically, and that's a big deal.

This personal touch means they are invested in your success, not just in finishing your forms. They want to see you do well, and they act as a guide to help you get there. That kind of care really sets a top tax preparer in Tulsa apart, in fact.

Finding Your Top Tax Preparer in Tulsa

So, how do you go about finding this kind of outstanding tax help right here in Tulsa? It takes a little bit of looking, but it is definitely worth the effort. You want to make sure you are making a choice that feels right for you and your money, you know.

Asking Around

One of the best ways to find a good tax preparer is to ask people you trust. Talk to your friends, family, or even co-workers in Tulsa. They might have someone they have worked with and had a good experience. Personal recommendations often point you to someone reliable, you know.

When you ask, try to get details. Ask what they liked most about their preparer. Did they explain things well? Were they easy to get a hold of? Did they seem to really understand their situation? These kinds of specific questions can give you a better idea of who might be a good fit for you, too.

You can also look at online reviews, but take them with a grain of salt, as a matter of fact. They can give you a general idea, but personal stories from people you know are often more trustworthy. It is about getting a real sense of how someone works, apparently.

Think about people in your professional network, too. If you have a financial advisor or a lawyer, they might know some good tax preparers in the area. They often work with these professionals and can give you an informed suggestion, which is pretty useful, you know.

The goal here is to get a few names, a short list of people who come highly recommended. This gives you a good starting point for your search. It is about gathering information from trusted sources, basically.

Checking Credentials

Once you have a few names, it is a good idea to check their credentials. This means making sure they have the right licenses and certifications to do tax work. For example, many top tax preparers are Certified Public Accountants (CPAs) or Enrolled Agents (EAs). These titles mean they have passed certain exams and meet specific professional standards, which is good to know.

You can often look up their licenses online through state boards or federal agencies. For CPAs, you would check with the Oklahoma Accountancy Board. For Enrolled Agents, you can check with the IRS. This step helps confirm they are legitimate and qualified, which is very important.

It also helps to see how long they have been working in the field. Someone with many years of experience has likely seen a lot of different tax situations. This experience can be a big plus, especially if your taxes are a bit more involved, you know.

You might also want to see if they belong to any professional groups. Memberships in organizations like the Oklahoma Society of CPAs or the National Association of Enrolled Agents can show a commitment to their profession and ongoing learning. These groups often have codes of conduct their members follow, too.

This step is about making sure the person you are considering has the formal qualifications to back up their experience. It adds another layer of confidence to your choice, which is pretty reassuring, in fact. You can learn more about choosing a tax professional on the IRS website.

Meeting for a Chat

After you have a few qualified names, try to schedule a short meeting or a phone call with each one. Many preparers offer a free initial consultation. This is your chance to ask questions and see if you feel comfortable with them. It is kind of like an interview, you know.

During this chat, ask about their fees. How do they charge? Is it by the hour, by the form, or a flat fee? Make sure you understand their pricing structure so there are no surprises later. Getting this clear upfront is a good idea, naturally.

Ask about their approach to tax preparation. Do they encourage year-round planning, or do they mostly focus on just filing your return? A top preparer might offer advice throughout the year, which can be really helpful for future tax seasons. This proactive approach is a good sign, very much so.

Pay attention to how they communicate. Do they explain things clearly? Do they seem genuinely interested in your situation? Do you feel heard? Your comfort level with them is a big factor, because you will be sharing personal financial information. It is a bit like finding a good doctor, in a way.

This meeting is also a good time to mention any specific concerns you have, like if you had a complicated tax year or if you are self-employed. See how they respond and if they seem confident in handling your particular needs. This helps you figure out if they are the right fit, honestly.

Common Questions About Tax Preparers

How much does a tax preparer typically cost in Tulsa?

The cost for a tax preparer in Tulsa can really change depending on how complicated your tax situation is. For a very simple return, it might be less. If you have a business, or many investments, or other special forms, it will likely cost more. It is always a good idea to ask about fees upfront during your first chat, so you know what to expect, basically.

What documents do I need to bring to a tax preparer?

You will want to bring all your income statements, like W-2s from your job or 1099s if you are self-employed. Also, bring documents for any deductions or credits you plan to claim, such as mortgage interest statements, property tax records, or receipts for medical expenses. Your preparer will give you a full list, but having these ready helps speed things along, you know.

Can a tax preparer help if I owe money?

Yes, absolutely. A top tax preparer can help you understand why you owe money and can explain your options for paying it. They might also help you set up a payment plan with the IRS if needed. Their job is to guide you through the process, even when it is not the best news, which is pretty helpful, really.

Making the Most of Your Tax Preparation

Once you pick a top tax preparer in Tulsa, there are things you can do to make the process smooth for both of you. It is a partnership, after all, and working together helps everyone. This means being prepared and ready to share information, you know.

First, gather all your documents before your appointment. This includes income statements, receipts for expenses, and any other papers related to your money. Having everything organized makes the preparer's job easier and helps them get your taxes done faster. It saves you time and money, too, typically.

Be honest and open with your preparer. Share all the details about your financial year, even if you think something is not important. Sometimes, a small detail can make a big difference in your tax outcome. They can only help you fully if they have the complete picture, basically.

Ask questions if you do not understand something. Remember, a top preparer wants you to understand what is happening. Do not be afraid to speak up if something is unclear. It is your money, and you have every right to know how it is being handled, in fact.

Consider planning throughout the year, not just at tax time. Your preparer might offer advice on how to manage your money to improve your tax situation for next year. Taking their advice during the year can make future tax seasons even easier. This forward thinking is a great way to use their knowledge, you know.

Keep good records all year long. This means saving receipts, keeping track of income, and organizing financial statements. Good record-keeping makes preparing for taxes much less stressful. It is a simple habit that pays off big time, really.

If you have any big life changes coming up, like starting a new job, buying a home, or having a baby, let your preparer know. These events can have a big impact on your taxes, and they can offer timely advice. Staying in touch helps them help you, you know, at the end of the day.

Review your return carefully before it is filed. Even the best preparers can make mistakes, and it is always good to double-check. Make sure all your information is correct and that you agree with everything on the forms. This final check is a really important step, too.

Building a good relationship with your tax preparer means you have someone reliable in your corner year after year. This can make tax season something you approach with confidence instead of dread. It is about having a trusted guide for your financial journey, which is pretty valuable, you know.

Learn more about our services on our site, and link to this page for more tax tips.

Your Next Steps to a Great Tax Season

Finding a top tax preparer in Tulsa is a step towards feeling more confident about your money. It is about choosing someone who brings great knowledge and a personal touch to your tax needs. Think about those qualities we talked about: their experience, how clearly they talk to you, and how much they seem to care, you know.

Start by asking around your circle for suggestions. Then, take a moment to check their qualifications to make sure they are properly certified. After that, have a little chat with a few of them to see who feels like the best fit for you. This way, you can get a real sense of how they work, which is pretty important.

Remember, a good tax preparer is more than just someone who fills out forms. They are someone who can offer valuable advice and help you feel secure about your financial papers. This is especially true as tax season gets closer in 2024, and everyone starts thinking about their filings. It is about making a smart choice for your future, basically.

So, take these steps to find that excellent tax preparer here in Tulsa. You deserve to feel good about your taxes, and with the right person helping you, that feeling is definitely within reach. It is about making your financial life a little bit easier, which is something we all want, honestly.

Shop Stylish Tops For Women Online | French Theory

Danika Top - Long Sleeve Knit Wrap Top in Beige | Showpo

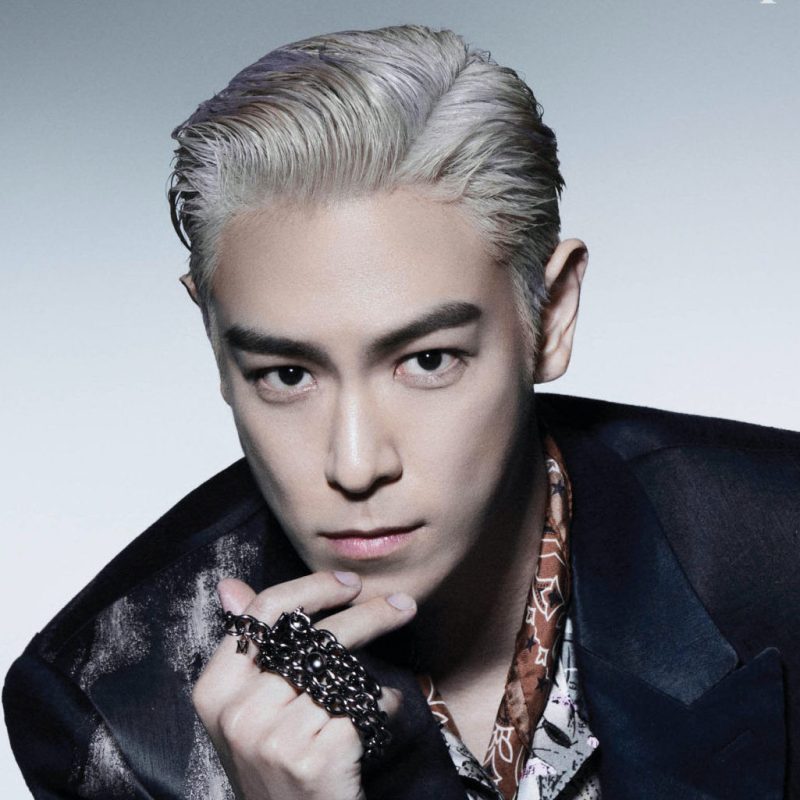

T.O.P (ex BIGBANG) Profile (Updated!) - Kpop Profiles