Forex trading in Victoria has gained immense popularity over the years, attracting both novice and experienced traders. The foreign exchange market, commonly known as forex, offers a dynamic platform for individuals and businesses to trade currencies and capitalize on global economic trends. Victoria, a vibrant hub for financial activities, provides a conducive environment for forex trading. In this article, we will explore the intricacies of forex trading in Victoria, covering everything from the basics to advanced strategies, ensuring you have the knowledge to navigate this lucrative market.

Forex trading is not just about buying and selling currencies; it involves a deep understanding of market dynamics, economic indicators, and geopolitical events. Victoria, with its robust financial infrastructure and regulatory framework, offers traders a secure and transparent environment to engage in forex trading. Whether you are a beginner looking to understand the basics or an experienced trader seeking advanced strategies, this guide will provide you with the insights you need to succeed in the forex market.

In this article, we will delve into the various aspects of forex trading in Victoria, including the regulatory landscape, trading platforms, strategies, and tips for success. By the end of this guide, you will have a comprehensive understanding of forex trading in Victoria and be equipped with the knowledge to make informed trading decisions. Let’s embark on this journey to explore the exciting world of forex trading in Victoria.

Read also:The Truth Behind Evelyns Role In Baldurs Gate 3

Table of Contents

- Introduction to Forex Trading

- Forex Regulations in Victoria

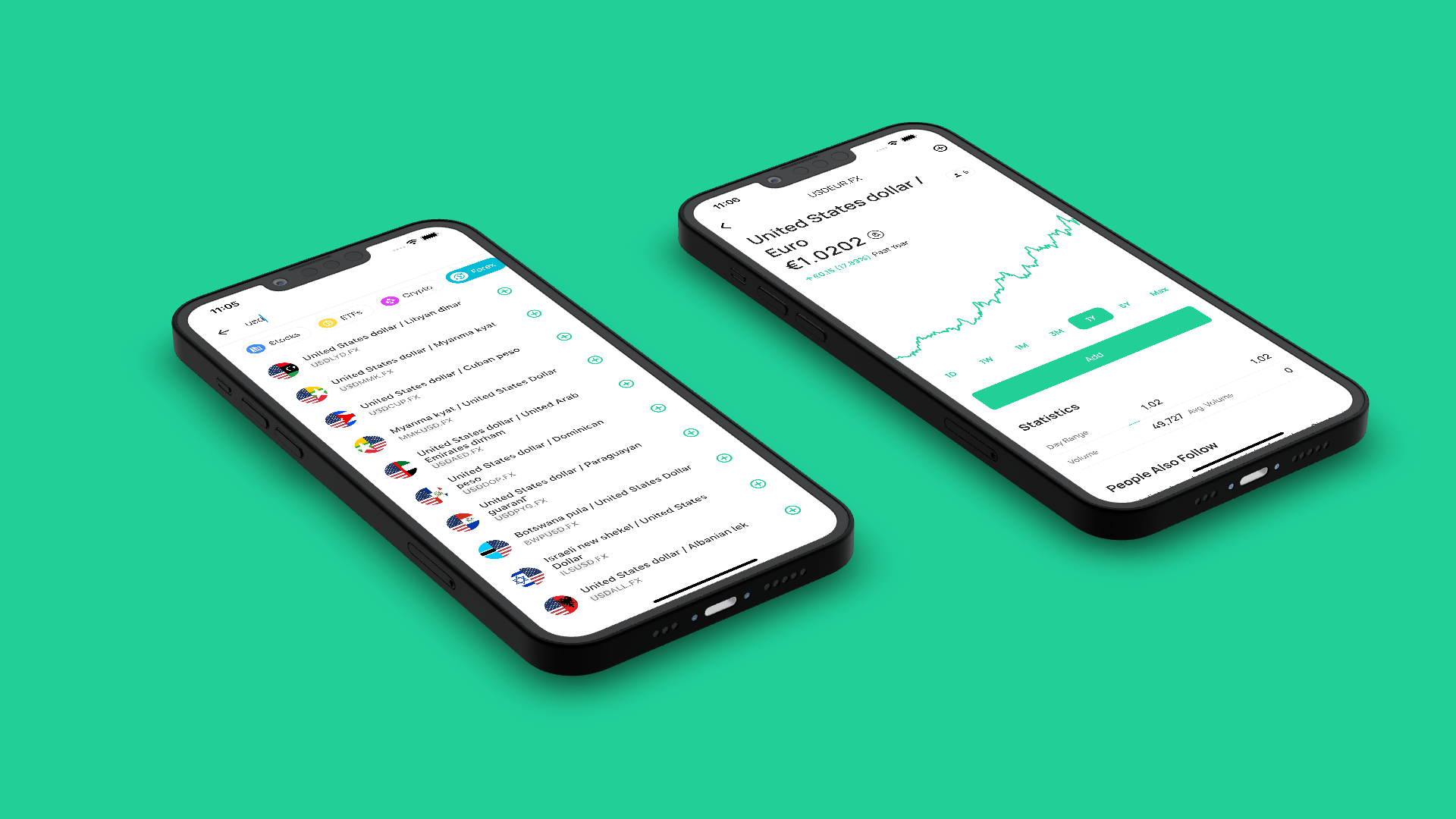

- Popular Forex Trading Platforms

- Essential Forex Trading Strategies

- Risk Management in Forex Trading

- Forex Trading Tips for Success

- Economic Indicators Affecting Forex

- Forex Trading Tools and Resources

- Common Mistakes to Avoid in Forex

- Conclusion and Call to Action

Introduction to Forex Trading

Forex trading, or foreign exchange trading, involves the buying and selling of currencies on the global market. It is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion. The forex market operates 24 hours a day, five days a week, allowing traders to engage in trading activities at any time.

One of the key features of forex trading is its decentralized nature. Unlike stock markets, which are centralized in specific exchanges, the forex market operates through a global network of banks, financial institutions, and individual traders. This decentralization provides traders with greater flexibility and access to a wide range of currency pairs.

Why Forex Trading is Popular in Victoria

Victoria's strategic location, robust financial infrastructure, and favorable regulatory environment make it an attractive destination for forex trading. The region's proximity to major financial markets in Asia and the Americas allows traders to capitalize on global economic trends and time zone differences. Additionally, Victoria's regulatory framework ensures a secure and transparent trading environment, fostering trust among traders.

Forex Regulations in Victoria

Regulation plays a crucial role in ensuring the integrity and stability of the forex market. In Victoria, forex trading is governed by stringent regulations designed to protect traders and maintain market transparency. These regulations are enforced by regulatory bodies such as the Australian Securities and Investments Commission (ASIC).

ASIC is responsible for overseeing financial markets and ensuring compliance with regulatory standards. It mandates that forex brokers operating in Victoria adhere to strict capital requirements, maintain segregated client accounts, and provide transparent pricing. These measures help safeguard traders' funds and ensure fair trading practices.

Benefits of Regulated Forex Brokers

- Security: Regulated brokers are required to adhere to strict security protocols, ensuring the safety of traders' funds.

- Transparency: Regulatory oversight promotes transparency in pricing and trading practices, fostering trust among traders.

- Account Protection: Segregated client accounts protect traders' funds from being used for operational purposes by brokers.

Popular Forex Trading Platforms

Choosing the right trading platform is essential for a successful forex trading experience. In Victoria, traders have access to a wide range of platforms, each offering unique features and tools to enhance trading efficiency. Some of the most popular forex trading platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

Read also:The Life And Career Of Toya Wrights Husband Career Achievements And Personal Insights

MetaTrader 4 is widely regarded as the industry standard for forex trading platforms. It offers a user-friendly interface, advanced charting tools, and a wide range of technical indicators. MT4 also supports automated trading through Expert Advisors (EAs), allowing traders to execute trades based on pre-defined strategies.

Features of MetaTrader 5

- Advanced Charting: MT5 offers enhanced charting capabilities, including more timeframes and technical indicators.

- Multi-Asset Trading: In addition to forex, MT5 supports trading in stocks, commodities, and indices.

- Improved Order Types: MT5 introduces new order types, such as stop-limit orders, providing greater flexibility in trade execution.

Essential Forex Trading Strategies

Successful forex trading requires a well-defined strategy that aligns with your trading goals and risk tolerance. There are various trading strategies available, each catering to different trading styles and market conditions. Some of the most popular forex trading strategies include scalping, day trading, swing trading, and position trading.

Scalping is a high-frequency trading strategy that involves making multiple trades throughout the day to capture small price movements. This strategy requires quick decision-making and a disciplined approach to risk management. Day trading, on the other hand, involves opening and closing trades within the same trading day, avoiding overnight risks.

Swing Trading Strategy

Swing trading is a medium-term trading strategy that aims to capture price swings over a few days to weeks. Traders using this strategy rely on technical analysis to identify potential entry and exit points. Swing trading requires patience and the ability to withstand short-term market fluctuations.

Risk Management in Forex Trading

Risk management is a critical component of successful forex trading. Without proper risk management, traders are exposed to significant financial losses. Effective risk management involves setting clear trading objectives, determining risk tolerance, and implementing risk mitigation strategies.

One of the fundamental principles of risk management is the use of stop-loss orders. A stop-loss order automatically closes a trade when the market moves against you, limiting potential losses. Traders should also diversify their portfolios by trading multiple currency pairs and asset classes to spread risk.

Position Sizing and Leverage

Position sizing refers to the amount of capital allocated to each trade. Proper position sizing ensures that no single trade can significantly impact your overall portfolio. Leverage, while offering the potential for higher returns, also increases risk. Traders should use leverage cautiously and understand its implications on their trading strategy.

Forex Trading Tips for Success

Achieving success in forex trading requires a combination of knowledge, discipline, and experience. Here are some tips to help you navigate the forex market and improve your trading performance:

- Educate Yourself: Continuous learning is essential for staying updated with market trends and trading strategies.

- Develop a Trading Plan: A well-defined trading plan outlines your trading goals, risk tolerance, and strategy.

- Practice with a Demo Account: Demo accounts allow you to practice trading without risking real money, helping you refine your skills.

Stay Informed and Adapt

The forex market is constantly evolving, influenced by economic indicators, geopolitical events, and market sentiment. Staying informed and adapting to changing market conditions is crucial for long-term success. Regularly review your trading performance and make necessary adjustments to your strategy.

Economic Indicators Affecting Forex

Economic indicators play a significant role in influencing currency movements in the forex market. Traders closely monitor these indicators to anticipate market trends and make informed trading decisions. Some of the key economic indicators that impact forex trading include interest rates, inflation rates, GDP growth, and employment data.

Interest rates set by central banks are one of the most influential factors affecting currency values. Higher interest rates attract foreign investment, leading to currency appreciation. Conversely, lower interest rates can result in currency depreciation as investors seek higher returns elsewhere.

Impact of Employment Data

Employment data, such as non-farm payrolls and unemployment rates, provide insights into the health of an economy. Strong employment figures indicate economic growth, boosting investor confidence and currency values. Weak employment data, on the other hand, can lead to currency depreciation as it signals economic slowdown.

Forex Trading Tools and Resources

Utilizing the right tools and resources can significantly enhance your forex trading experience. There are various tools available to assist traders in analyzing the market, executing trades, and managing risk. Some of the essential forex trading tools include charting software, economic calendars, and trading calculators.

Charting software provides traders with advanced technical analysis capabilities, allowing them to identify trends and patterns in the market. Economic calendars keep traders informed about upcoming economic events and data releases that may impact currency movements. Trading calculators help traders determine position sizes, risk levels, and potential profits or losses.

Importance of Economic Calendars

Economic calendars are invaluable tools for forex traders, providing a schedule of key economic events and data releases. By staying informed about upcoming events, traders can anticipate market volatility and adjust their trading strategies accordingly. Economic calendars also help traders align their trades with market-moving events, increasing the likelihood of successful outcomes.

Common Mistakes to Avoid in Forex

Forex trading can be challenging, and even experienced traders can make mistakes that lead to financial losses. Being aware of common pitfalls and taking steps to avoid them is essential for long-term success. Some of the most common mistakes in forex trading include overtrading, neglecting risk management, and emotional trading.

Overtrading occurs when traders execute too many trades without a clear strategy, leading to increased transaction costs and potential losses. Neglecting risk management exposes traders to unnecessary risks, jeopardizing their trading capital. Emotional trading, driven by fear or greed, can result in impulsive decisions that deviate from a well-defined trading plan.

Importance of Discipline

Discipline is a cornerstone of successful forex trading. It involves adhering to your trading plan, managing risk effectively, and maintaining emotional control. By cultivating discipline, traders can avoid common mistakes and achieve consistent results in the forex market.

Conclusion and Call to Action

Forex trading in Victoria offers a wealth of opportunities for traders seeking to capitalize on global currency movements. With its robust financial infrastructure, favorable regulatory environment, and access to advanced trading platforms, Victoria provides an ideal setting for forex trading. By understanding the intricacies of the forex market and implementing effective trading strategies, you can achieve success in this dynamic and lucrative market.

We hope this guide has provided you with valuable insights into forex trading in Victoria. Whether you are a beginner or an experienced trader, continuous learning and adaptation are key to navigating the ever-changing forex landscape. We encourage you to apply the knowledge gained from this article and explore the exciting world of forex trading. Feel free to leave a comment, share this article, or explore other resources on our site to further enhance your trading journey.