Are you ready for the 2024 tax brackets? Understanding how they work is crucial for effective financial planning and maximizing your savings. Tax brackets determine the percentage of your income that goes toward federal taxes, and staying informed about the latest changes ensures you're prepared. For the 2024 tax year, the IRS has announced adjustments to account for inflation, which could impact your tax obligations. Whether you're a salaried employee, a business owner, or someone planning for retirement, knowing the ins and outs of these brackets can help you make smarter financial decisions.

Every year, the IRS updates tax brackets to reflect changes in the economy, ensuring that taxpayers aren't unfairly penalized due to inflation. The 2024 tax brackets introduce slight increases in income thresholds, meaning you might fall into a different tax bracket compared to previous years. These adjustments are designed to provide relief to taxpayers, but they also require careful consideration to avoid surprises during tax season. For instance, understanding marginal tax rates and how deductions affect your taxable income can significantly lower your overall tax burden.

With tax season just around the corner, now is the perfect time to familiarize yourself with the 2024 tax brackets. Whether you're filing as an individual, a head of household, or a married couple filing jointly, knowing your tax rate can help you plan your finances more effectively. From leveraging tax credits to optimizing your retirement contributions, the 2024 tax brackets offer opportunities to save money. Let’s dive deeper into the specifics and explore how you can navigate this year's tax landscape with confidence.

Read also:The Truth Behind Evelyns Role In Baldurs Gate 3

Table of Contents

- What Are Tax Brackets and How Do They Work?

- How Do the 2024 Tax Brackets Differ from Previous Years?

- What Are the Income Thresholds for 2024 Tax Brackets?

- How Can You Optimize Your Tax Savings in 2024?

- What Are the Key Deductions and Credits for 2024?

- How Do Tax Brackets Affect Retirement Planning?

- Are There State-Specific Tax Bracket Rules for 2024?

- What Should You Know About Filing Status and Tax Brackets?

What Are Tax Brackets and How Do They Work?

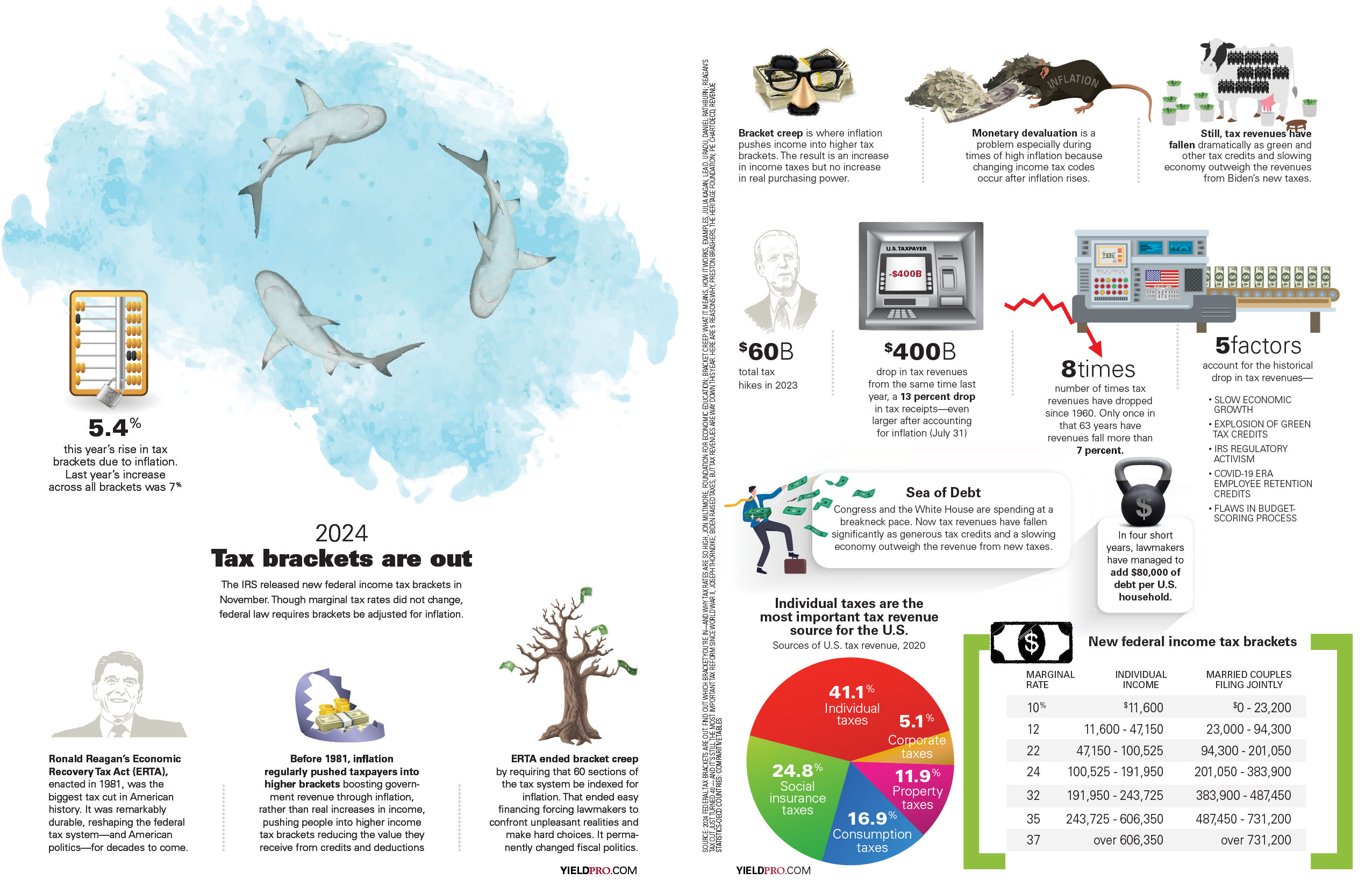

Tax brackets are a fundamental part of the U.S. tax system, designed to ensure that individuals pay taxes based on their income levels. The system operates on a progressive tax structure, meaning that as your income increases, you move into higher tax brackets, and a larger percentage of your income is taxed. However, it's essential to note that only the income within each bracket is taxed at that rate. For example, if you're in the 24% tax bracket, only the portion of your income that exceeds the threshold for the 22% bracket will be taxed at 24%.

Understanding marginal tax rates is key to navigating the tax system effectively. Marginal tax rates refer to the rate at which your last dollar of income is taxed. For instance, if you're a single filer earning $50,000 annually in 2024, your income would be taxed at 10% for the first $11,600, 12% for the income between $11,601 and $47,150, and 22% for the remaining amount. This tiered system ensures that taxpayers aren't unfairly taxed at higher rates for their entire income, which is a common misconception.

Additionally, tax brackets are influenced by your filing status, which includes options like single, married filing jointly, married filing separately, and head of household. Each filing status has its own set of income thresholds, which can significantly impact your tax liability. For example, married couples filing jointly often benefit from higher income thresholds before moving into higher tax brackets, providing them with potential tax advantages. Understanding these nuances can help you make informed decisions about your filing status and overall tax strategy.

How Do the 2024 Tax Brackets Differ from Previous Years?

Each year, the IRS adjusts tax brackets to account for inflation, ensuring that taxpayers aren't pushed into higher tax brackets due to rising living costs. For 2024, these adjustments are particularly noteworthy, as they reflect the ongoing economic changes and inflation rates observed in recent years. One of the most significant updates is the increase in income thresholds across all tax brackets. For instance, the income range for the 22% tax bracket for single filers has been expanded, allowing more individuals to remain in lower tax brackets despite slight increases in their earnings.

What Changes Were Made to the Income Thresholds?

The IRS has raised the income thresholds for each tax bracket to align with inflation. For example, the 12% tax bracket for single filers now applies to income between $11,601 and $47,150, compared to $11,000 and $44,725 in the previous year. Similarly, married couples filing jointly will see their 22% tax bracket apply to income between $89,451 and $190,750, up from $89,450 and $179,050. These adjustments mean that taxpayers may owe slightly less in taxes compared to previous years, as more of their income is taxed at lower rates.

Why Are These Adjustments Important for Taxpayers?

These changes are crucial because they help mitigate the impact of "bracket creep," a phenomenon where inflation pushes taxpayers into higher tax brackets without a real increase in purchasing power. By adjusting the brackets, the IRS ensures that taxpayers aren't unfairly penalized for inflation-driven income growth. For example, someone earning a modest raise might otherwise find themselves in a higher tax bracket, leading to higher tax liabilities. The 2024 adjustments help alleviate this issue, providing taxpayers with more financial stability and predictability.

Read also:Jean Stapleton Sister Untold Stories And Facts

Moreover, these updates highlight the importance of staying informed about annual tax changes. Taxpayers who fail to account for these adjustments may miss out on potential savings or inadvertently overpay their taxes. By understanding how the 2024 tax brackets differ from previous years, you can better plan your finances and take full advantage of the updated thresholds.

What Are the Income Thresholds for 2024 Tax Brackets?

The 2024 tax brackets introduce updated income thresholds that cater to various filing statuses, ensuring a fair and equitable tax system. These thresholds determine the percentage of your income that will be taxed at different rates, making it essential to understand how they apply to your specific situation. Below, we break down the income thresholds for each filing status, highlighting how they impact your tax obligations.

Income Thresholds for Single Filers

For single filers, the 2024 tax brackets are as follows:

- 10%: Up to $11,600

- 12%: $11,601 to $47,150

- 22%: $47,151 to $95,375

- 24%: $95,376 to $182,100

- 32%: $182,101 to $231,250

- 35%: $231,251 to $578,125

- 37%: Over $578,125

These thresholds indicate that single filers earning up to $11,600 will pay 10% in taxes, while those earning between $11,601 and $47,150 will be taxed at 12%. The progressive nature of these brackets ensures that only the income within each range is taxed at the corresponding rate.

Income Thresholds for Married Couples Filing Jointly

For married couples filing jointly, the 2024 tax brackets are structured as follows:

- 10%: Up to $23,200

- 12%: $23,201 to $94,300

- 22%: $94,301 to $190,750

- 24%: $190,751 to $364,200

- 32%: $364,201 to $462,500

- 35%: $462,501 to $693,750

- 37%: Over $693,750

Married couples filing jointly benefit from higher income thresholds, allowing them to remain in lower tax brackets even as their combined income increases. This can result in significant tax savings compared to filing separately.

Income Thresholds for Heads of Household

Heads of household, who often have dependents to support, enjoy slightly higher income thresholds than single filers:

- 10%: Up to $15,700

- 12%: $15,701 to $59,850

- 22%: $59,851 to $95,350

- 24%: $95,351 to $182,100

- 32%: $182,101 to $231,250

- 35%: $231,251 to $578,100

- 37%: Over $578,100

These thresholds reflect the IRS's recognition of the additional financial responsibilities shouldered by heads of household, providing them with a more favorable tax structure.

Understanding these income thresholds is crucial for effective tax planning. By knowing which bracket your income falls into, you can make informed decisions about deductions, credits, and other strategies to minimize your tax liability.

How Can You Optimize Your Tax Savings in 2024?

Maximizing your tax savings in 2024 requires a strategic approach that combines knowledge of the updated tax brackets with proactive financial planning. One of the most effective ways to reduce your taxable income is by leveraging tax deductions and credits. Contributions to retirement accounts like 401(k)s and IRAs not only help secure your financial future but also lower your taxable income. For example, contributions to a traditional IRA are tax-deductible, meaning they reduce your taxable income dollar-for-dollar, potentially moving you into a lower tax bracket.

What Are the Best Tax Deductions for 2024?

Several deductions can significantly reduce your tax liability in 2024:

- Standard Deduction: For 2024, the standard deduction has increased to $13,850 for single filers and $27,700 for married couples filing jointly. Taking the standard deduction simplifies the filing process and often results in greater savings than itemizing.

- Student Loan Interest Deduction: If you're paying off student loans, you can deduct up to $2,500 of interest paid, provided your income falls below the specified limits.

- Medical Expense Deduction: You can deduct medical expenses that exceed 7.5% of your adjusted gross income (AGI). This is particularly beneficial for those with significant healthcare costs.

How Can Tax Credits Boost Your Savings?

Tax credits are even more valuable than deductions because they directly reduce your tax bill. Some of the most impactful credits for 2