If you've been keeping up with recent economic developments, you've likely heard about IRS stimulus checks. These payments, designed to provide financial relief to individuals and families, have played a significant role in stabilizing households during challenging times. From the initial rounds of payments to subsequent updates, the IRS has been at the forefront of distributing these funds to eligible recipients. Whether you're a taxpayer wondering about eligibility or someone curious about how these checks impact the broader economy, this article will guide you through everything you need to know.

The IRS stimulus checks have been a lifeline for millions of Americans, helping them cover essential expenses such as rent, groceries, and healthcare costs. These payments were introduced as part of legislative measures aimed at mitigating the financial strain caused by unexpected economic downturns. Over the years, the IRS has refined the process, ensuring that eligible individuals receive their payments efficiently and accurately.

While the primary goal of these checks is to provide immediate financial assistance, they also serve as a tool for boosting consumer spending and stimulating the economy. Understanding how these payments work, who qualifies, and what to expect in future rounds can empower you to make informed decisions. In this article, we'll dive deep into the details, answer common questions, and explore the broader implications of IRS stimulus checks.

Read also:The Actor Behind Nick Nelson A Detailed Insight

Table of Contents

- What Are IRS Stimulus Checks?

- Who Is Eligible for IRS Stimulus Checks?

- How Do You Claim Missed IRS Stimulus Checks?

- What Are the Economic Impacts of IRS Stimulus Checks?

- How Are IRS Stimulus Checks Distributed?

- Can You Track Your IRS Stimulus Check?

- What Are the Common Misconceptions About IRS Stimulus Checks?

- Are There Future Plans for IRS Stimulus Checks?

What Are IRS Stimulus Checks?

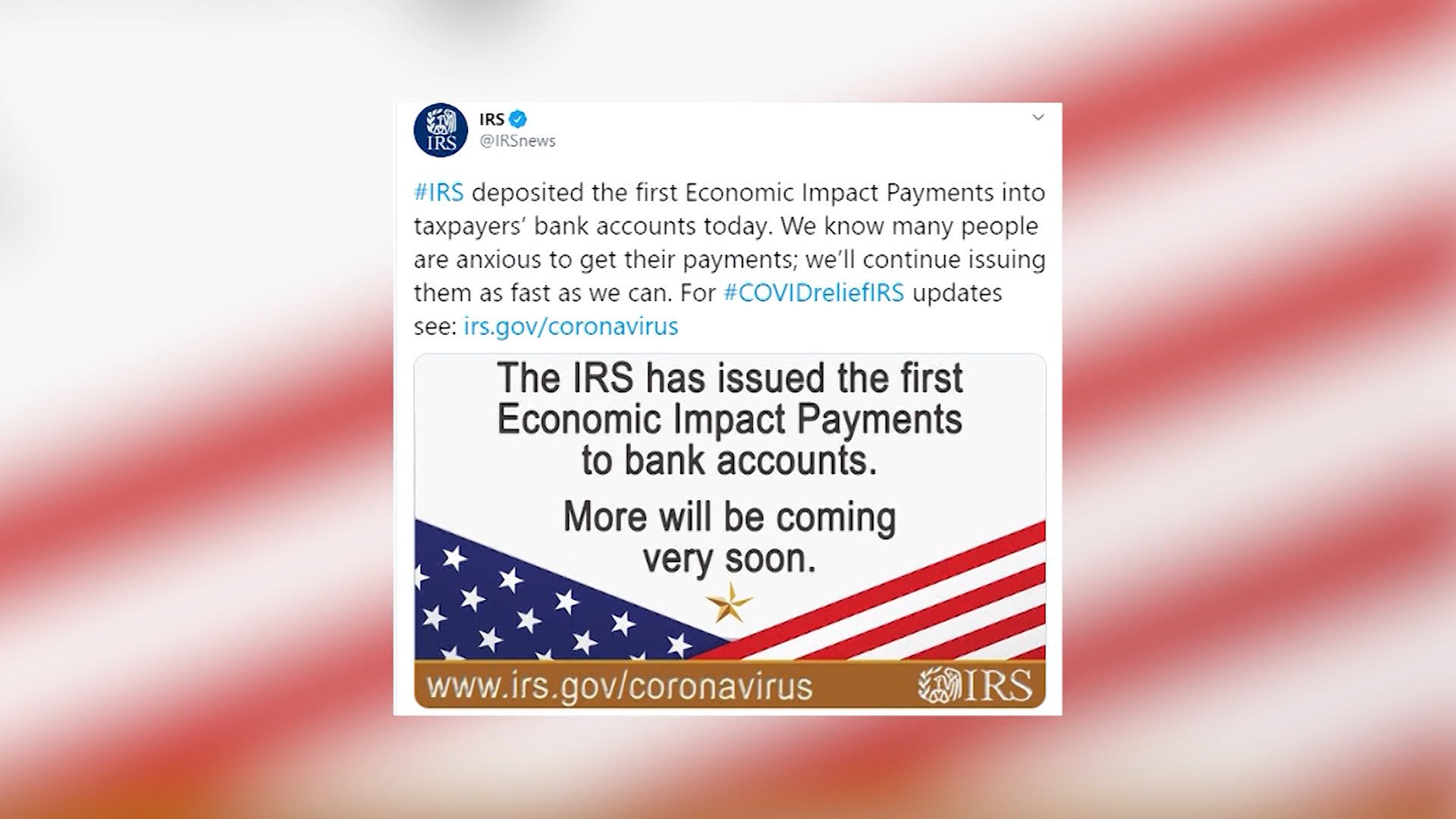

IRS stimulus checks are direct payments issued by the Internal Revenue Service (IRS) to eligible taxpayers as part of government efforts to provide financial relief during economic crises. These payments are typically authorized by Congress and funded through legislation such as the CARES Act or subsequent economic relief packages. The primary purpose of these checks is to help individuals and families cope with financial hardships caused by events like the COVID-19 pandemic, natural disasters, or economic recessions.

Each round of IRS stimulus checks has its own set of rules and qualifications. For example, the first round of payments in 2020 provided up to $1,200 per individual and $2,400 for married couples filing jointly, with additional funds for qualifying dependents. Subsequent rounds adjusted the amounts and eligibility criteria based on economic conditions and legislative updates. The IRS uses tax return information to determine eligibility and calculate payment amounts.

These payments are typically disbursed via direct deposit, paper checks, or prepaid debit cards. The IRS has made efforts to streamline the process, ensuring that funds reach recipients as quickly as possible. However, delays and errors can occur, especially for individuals who haven't filed recent tax returns or whose banking information has changed. Understanding the basics of IRS stimulus checks can help you navigate the process and ensure you receive your payment.

Who Is Eligible for IRS Stimulus Checks?

Eligibility for IRS stimulus checks depends on several factors, including income, filing status, and dependents. The IRS uses information from your most recent tax return to determine whether you qualify for a payment. Here's a breakdown of the key eligibility criteria:

- Income Limits: Payments are phased out for individuals earning above a certain threshold. For example, single filers with an adjusted gross income (AGI) exceeding $75,000 may receive reduced payments.

- Filing Status: Married couples filing jointly, heads of households, and single filers all have different income thresholds and payment amounts.

- Dependents: In some rounds, qualifying dependents, including children and adult dependents, were eligible for additional payments.

It's important to note that not everyone qualifies for IRS stimulus checks. Nonresident aliens, individuals who can be claimed as dependents on someone else's tax return, and those without a Social Security number are generally excluded. Additionally, individuals with very high incomes may not receive any payment due to the phase-out structure.

What If You Haven't Filed Taxes Recently?

If you haven't filed a tax return recently, you might still be eligible for IRS stimulus checks. The IRS has set up tools like the "Non-Filer" portal to help individuals provide necessary information. However, failing to file a return or update your information could result in missed payments. It's crucial to stay informed and take proactive steps to ensure you receive your stimulus check.

Read also:Mr Rogers Financial Legacy What Was His Net Worth

How Do You Claim Missed IRS Stimulus Checks?

If you believe you're eligible for a stimulus check but haven't received it, there are steps you can take to claim your missed payment. The IRS provides resources to help individuals track and recover their payments. Here's what you need to do:

- Check Your Payment Status: Use the IRS "Get My Payment" tool to verify whether your payment has been issued, is pending, or has been returned.

- File a Recovery Rebate Credit: If you missed a stimulus check, you might be able to claim it as a Recovery Rebate Credit on your next tax return.

- Update Your Information: Ensure your banking details and mailing address are up to date with the IRS to avoid future delays.

It's essential to act promptly if you believe you've missed a payment. The IRS typically sets deadlines for claiming missed stimulus checks, and failing to meet these deadlines could result in losing out on financial assistance.

Why Haven't You Received Your Stimulus Check Yet?

There are several reasons why you might not have received your IRS stimulus check. Common issues include outdated banking information, incorrect mailing addresses, or errors in your tax return. In some cases, payments may have been delayed due to processing times or technical glitches. Understanding the root cause of the issue can help you take the appropriate steps to resolve it.

What Are the Economic Impacts of IRS Stimulus Checks?

IRS stimulus checks have far-reaching effects on both individuals and the broader economy. For recipients, these payments provide much-needed financial relief, helping them cover essential expenses and reduce financial stress. On a macroeconomic level, stimulus checks can boost consumer spending, which is a key driver of economic growth.

Studies have shown that IRS stimulus checks increase disposable income, leading to higher spending on goods and services. This, in turn, supports businesses, creates jobs, and stimulates economic activity. However, critics argue that these payments can contribute to inflation if not managed properly. Balancing the benefits and potential drawbacks is crucial for policymakers when designing future stimulus programs.

How Are IRS Stimulus Checks Distributed?

The distribution of IRS stimulus checks involves a multi-step process that relies on accurate taxpayer information. Payments are typically disbursed through direct deposit, paper checks, or prepaid debit cards. The IRS prioritizes direct deposit for faster delivery, but not all recipients have this option available.

What Are the Challenges in Distributing IRS Stimulus Checks?

Distributing IRS stimulus checks comes with its own set of challenges. Errors in taxpayer information, outdated banking details, and processing delays can all hinder the smooth delivery of payments. Additionally, individuals who don't typically file tax returns may face difficulties in receiving their checks unless they take proactive steps to provide their information.

Can You Track Your IRS Stimulus Check?

Yes, you can track your IRS stimulus check using the "Get My Payment" tool on the IRS website. This tool provides real-time updates on the status of your payment, including whether it has been issued, is pending, or has been returned. Tracking your payment can help you stay informed and take action if there are any issues.

What Are the Common Misconceptions About IRS Stimulus Checks?

There are several misconceptions about IRS stimulus checks that can lead to confusion. For example, some people believe that these payments are considered taxable income, but they are actually tax credits. Others mistakenly think that all taxpayers automatically qualify for stimulus checks, regardless of income or filing status.

Are There Future Plans for IRS Stimulus Checks?

While there are no guarantees, future rounds of IRS stimulus checks could be introduced depending on economic conditions and legislative priorities. Policymakers continue to evaluate the effectiveness of these payments and may consider additional measures if needed. Staying informed about potential updates can help you prepare for future opportunities.

Frequently Asked Questions (FAQs)

1. How Much Are IRS Stimulus Checks Worth?

The amount of IRS stimulus checks varies depending on the round and your income level. For example, the first round provided up to $1,200 per individual, while subsequent rounds adjusted the amounts based on updated legislation.

2. Do I Need to Repay My Stimulus Check?

No, you do not need to repay your IRS stimulus check. These payments are considered tax credits and are not taxable income.

3. What Should I Do If My Stimulus Check Was Lost or Stolen?

If your IRS stimulus check was lost or stolen, you can contact the IRS to request a replacement. Be prepared to provide documentation to verify your claim.

For more information, visit the official IRS website.

In conclusion, IRS stimulus checks have played a vital role in providing financial relief to millions of Americans. By understanding how these payments work, who qualifies, and what to do if you encounter issues, you can make the most of this important economic resource.